A popular topic in personal finance is passive income.

Income that doesn’t require you to trade your time for money is “the dream” for many people.

There are many different forms of passive income, but the ultimate passive income is dividend income.

Dividend income comes from owning dividend-paying stocks. Not every company pays dividends. If a company is focused 100% on growth, they are going to use all their earnings to continue to grow their business.

With that being said there are many large companies that are focused on growth that pay a dividend. In fact it would almost be silly for a publicly traded company to not have a growth strategy.

Many of the large blue chip companies pay dividends, though their dividend yield (Amount paid out in dividends annually divided by current stock price) can vary. For example, Best Buy has a relatively high dividend yield of 4.18%, while Visa has a modest 0.80% dividend yield.

Even if you have other financial priorities that take precedence, learning and being aware of the opportunities that come with dividend income can motivate people to save more money, pay off debt faster, and make more money so that they can take advantage of all the benefits that come from dividend income.

With that in mind, let’s get to the real question here: how much can you make in dividend income?

How Much Can You Make in Dividend Income?

The first thing I need to say before answering this question is this: it’s not easy to make a sizable amount of dividend income. If it was easy no one would work and everyone would simply live off of their passive dividend income.

Using the spreadsheet I created, let’s look at what you would be able to make annually from dividends if you invested $5,000 in 3M stocks:

Okay so you’d only make $123 each year. Now that may not feel like much, but remember it’s also reasonable to expect 3M’s stock to appreciate over time. Also, don’t forget how great dividend income is: you are getting $123 by simply owning $5,000 worth of 3M stock! No effort required.

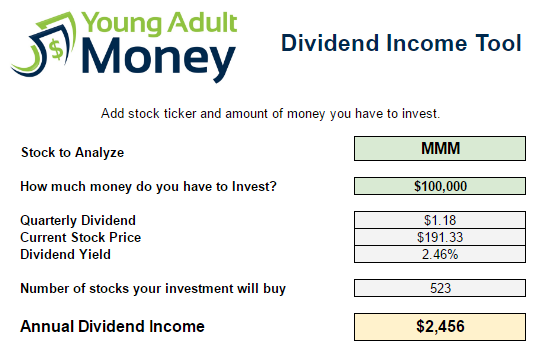

Let’s take a look at a higher investment amount: $100,000.

Nearly $2,500 a year – not too bad! You can see why dividend income is so attractive, especially to those looking to retire early or who don’t want to spend down their assets in retirement.

Quick math shows that owning $1 million of 3M stock would yield $25,000 a year in entirely passive income. Do you have $2 million to invest? double it up to $50,000 a year.

I don’t know about you, but this sort of scenario analysis is incredibly motivating to me.

I spend most of my free time working on side hustles to increase my income, and while paying off debt is the primary goal right now, long-term I would love to regularly funnel “extra” side hustle income into dividend-paying stocks.

If you are an entrepreneur or want to be an entrepreneur, dividend income just might give you the motivation needed to put in the long hours and hard work to build your business. After all, if you are able to sell for a couple million dollars – or more – you very well could live off of passive dividend income the rest of your life.

Want to try out some scenarios in the dividend income tool?

Get the spreadsheet below and find out how much you can make in dividend income with your current and future investments.

The post How Much Can You Make in Dividend Income? This Spreadsheet Will Show You first appeared on Adult Affiliate Guide.

Source: youngadultmoney.com